“I have not seen a market this volatile in my 66-year career”

John Clifton “Jack” Bogle – Founder of Vanguard Group

Download White Paper

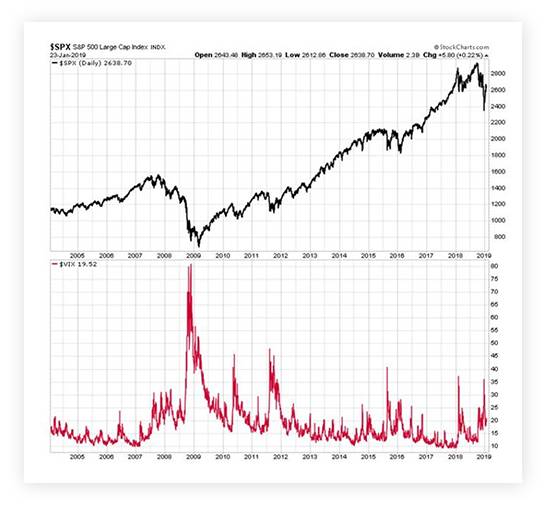

A volatility targeting approach uses dynamic asset allocation to achieve a stable level of volatility in all market environments by taking advantage of the negative relationship between volatility and return as well as the persistence of volatility. Volatility is negatively correlated with equity returns. As a result, a strategy which reduces volatility in periods when volatility is high and/or rising and which increases volatility in periods when volatility is low and/or falling is more likely to add value.

Take a look at this 15-year daily chart – the top window (black line) is the S&P 500 index. The lower window (red line) is the VIX, a measure of stock market volatility. Notice the inverse correlation between returns and risk.

If you have any questions or would like to discuss whether Jackson Wealth Management is right for you, we’d love to hear from you. Call or send us an email to schedule a no-obligation initial conversation.